The Rise and Fall of Overpriced NFT Tennis Balls

In a shocking turn of events, Tennis Australia’s bold venture into the world of Non-Fungible Tokens (NFTs) has taken a nosedive, leaving investors scratching their heads and questioning the true value of digital collectibles.

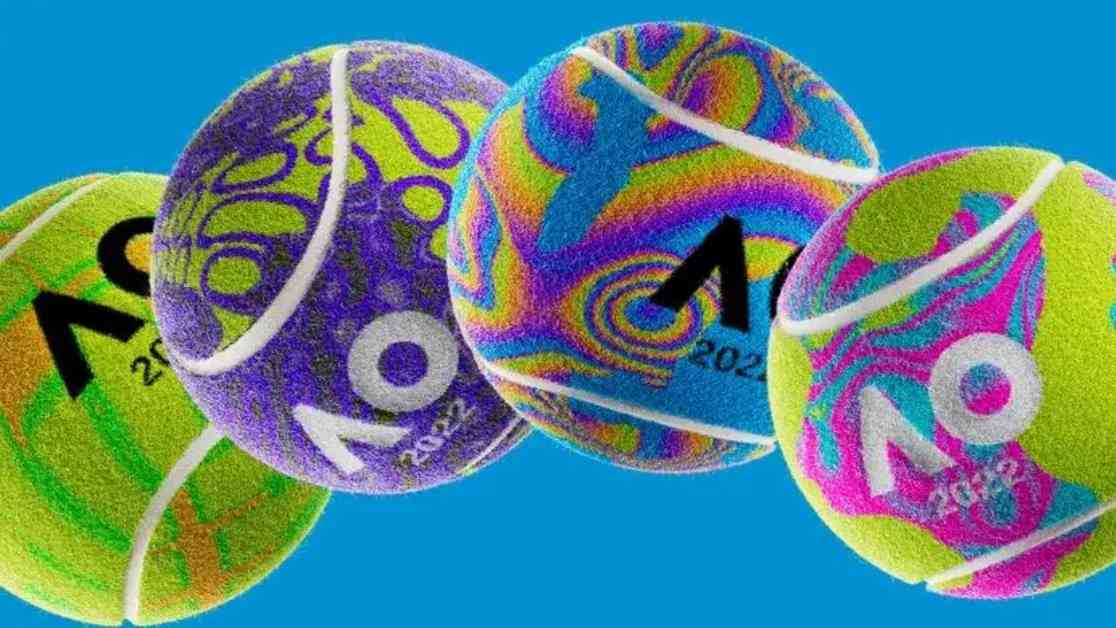

Back in 2022, Tennis Australia made waves with its release of 6,776 NFTs depicting tennis balls linked to specific court plots at the Australian Open in Melbourne. Each NFT was priced at 0.067ETH, equivalent to around $278 AUD at the time. However, fast forward to the present day, and these once highly sought-after digital assets are reportedly trading for as little as 0.003ETH or $15 AUD on OpenSea, a significant drop in value that has left many reeling.

The Initial Promise and Disappointing Reality

Initially, Tennis Australia marketed these NFTs as a unique opportunity for fans to own a piece of tennis history, with promises of exclusive access and rewards for NFT owners. The concept was likened to an airline frequent flyer program, offering perks such as ground passes for finals weeks, behind-the-scenes access, and tickets to matches for NFT owners whose court plots were linked to match points.

However, as time went on, it became increasingly clear that the value proposition of these NFTs was not as solid as initially presented. Despite the organization’s commitment to NFTs for the long term, the volatile nature of cryptocurrency markets and the lack of sustained interest from investors ultimately led to a decline in value and participation.

The Silent Disappearance

In 2023, Tennis Australia released a second wave of NFTs, further adding to the total sales revenue of around $3 million AUD. However, by 2024, the organization seemed to have quietly abandoned the NFT scheme, with no new releases and a notable absence of promotion during the Australian Open tournament. The closure of the Discord server, dormant websites, and lack of response to inquiries from media outlets suggest that Tennis Australia has distanced itself from the NFT debacle.

In a world where digital assets can skyrocket in value overnight, the cautionary tale of Tennis Australia’s overpriced NFT tennis balls serves as a reminder that not all investments are guaranteed to pay off. As the dust settles on this failed experiment, one thing remains clear: the allure of NFTs may be fleeting, but the lessons learned are enduring.

Conclusion: Lessons Learned

As we navigate the ever-evolving landscape of digital collectibles and blockchain technology, it’s essential to approach investments with a critical eye and a discerning mind. While the allure of quick profits and exclusive rewards may be tempting, the reality of the market’s unpredictability and potential pitfalls cannot be ignored.

In the end, the story of Tennis Australia’s ill-fated NFT venture serves as a cautionary tale for investors and organizations alike: tread carefully in the world of digital assets, for what glitters today may fade tomorrow.